Containerization in Shipping and the Moderate Growth of Maritime Trade

The global maritime trade sector has exhibited resilience and moderate growth since 2023, serving as a critical barometer for the world economy. Despite a contraction in 2022, total volumes rebounded to 12.292 million tons, marking a 2.4% increase fueled by a better-than-anticipated global economic performance. Notably, a 2.7% growth that successfully averted a predicted recession.

This expansion was significantly underpinned by the resilience of key economies, such as the United States, and the bolstering effect of China’s economy. However, this growth narrative remains complex, shadowed by persistent supply chain disruptions, market volatility fueled by geopolitical tensions, and extreme weather events.

These complex challenges underscore the industry’s increasing focus on operational efficiency and environmental responsibility. As extreme weather events highlight climate risks, the maritime sector is actively investing in greener fleets.

Against this backdrop of growing yet challenging demand, the standardized and efficient movement provided by containerization remained the indispensable backbone for managing the vast flow of global goods. This period also saw significant shifts in operational dynamics, including Developing Countries (Dcs) experiencing 30–70% higher transport costs for imported goods than other groups, and, for the first time ever, China delivering more than 50% of the world’s new ship capacity.

A crucial development within this context is the shift to longer shipping routes, evidenced by seaborne trade growth in ton-miles outpacing the growth measured purely in tons. This indicated that cargo is traveling greater average distances, a trend that profoundly impacts logistical efficiency and costs. This article explores the interconnected roles of containerization and maritime trade in navigating this era of moderate growth and sustained complexity.

The Indispensable Role of Containerization in Modern Maritime Shipping

The terms containerized shipping, containerization in maritime shipping, and containerization in maritime transport all point to one of the most transformative innovations in the global supply chain. Containerization, as popularized by logistics giants like DHL, is the system of using steel intermodal containers to handle, store, and transport goods across different modes of transportation, including ship, rail, and truck, without intermediate handling of the cargo itself. This standardized system forms the bedrock of the modern supply chain and is the key to the speed and efficiency of international trade.

The success of containerization in shipping is built upon strict international standards, or ISO (International Organization for Standardization), that ensure seamless interchangeability across the globe:

- Principal Categories: The most common lengths are 20-foot and 40-foot containers. Standard widths are typically 8 feet, with heights varying between 8 feet, 8.5 feet, and 9.5 feet. Containers exceeding these dimensions are usually described as “oversized containers.”

- Weight vs. Volume: Containers are designed with cargo density in mind. Denser cargo is often carried in shorter containers (like the 20-foot container), as they are structurally stronger to support the weight. Crucially, the maximum cargo weight for a 40-foot container is generally less than 50% more than that of a 20-foot container, highlighting the structural limits for extremely heavy loads.

- Optimizing Packing: Varying container heights (e.g., 8.5-foot vs. 9.5-foot “High Cubes”) enables the optimization of packing consignment units, effectively providing gradations of optimum packing density and allowing for the transport of taller items.

Standardized Sizes: The Foundation of Efficiency

The success of containerization in shipping is built upon strict international standards that ensure seamless interchangeability across the globe. The principal size categories define how goods are packaged, moved, and stacked:

- Main Container Sizes:

- 20 Foot ISO container (length of 20 feet and width of 8 feet)

- 40 Foot ISO container (length of 40 feet and width of 8 feet)

- ISO container over 20 feet and under 40 feet in length

- ISO container over 40 feet long

- Super high cube container (oversized container)

- Air container (conforming to standards designed for air transportation)

- Container Heights: Containers are normally 8 feet tall, but various heights exist. “High Cube Containers” are widely used, featuring a height of 9.5 feet for increased volume. “Super High Cube Containers” exceed the standard ISO dimensions, including container lengths of 45 feet, 48 feet, and 53 feet.

- Note on Exclusions: It is important to note that the so-called SECU boxes (Stora Enso Cargo Units) used for bulk cargo in some ports are typically not classified as oversized containers, as they are too big to be lifted on and off a vessel.

Specialized Container Types and Challenges

While the dry freight standard container dominates, the flexibility of the container system extends to highly specialized cargo needs (e.g., refrigerated containers, tank containers, and flats). Despite the high level of standardization, minor inconsistencies still exist between international container standards, road goods vehicles, and common pallet sizes, which can limit the number of pallet loads that can be efficiently loaded.

Ultimately, containerization in shipping remains the unparalleled engine of global trade, continuously adapting through standardized sizes and specialized variants to meet the diverse and growing demands of the modern supply chain.

To truly master the art of space optimization, it is crucial to fully understand the limits and loading possibilities of not only containers but also of various trailers and trucks. Explore the complete list of the most common shipping containers, trailers, and trucks to optimize your shipments today.

Beyond Boxes: The Role of Ro-Ro Units in Maritime Cargo

While containerization provides the standardized backbone for dry goods, the maritime sector relies heavily on Roll-on/Roll-off (Ro-Ro) units for handling wheeled cargo. According to the Directive, a Ro-Ro unit refers to wheeled equipment for carrying cargo, such as a truck, trailer, or semi-trailer, that can be driven or towed directly onto a vessel. This definition also explicitly includes port or ship trailers and extends to live animals and vehicles being transported as cargo (as opposed to vehicles used for freight or passenger transport).

Ro-Ro cargo encompasses the goods, whether or not they are already in containers, that are loaded onto these Ro-Ro units and subsequently rolled on and off the vessels that carry them by sea.

- Port Trailers or Ships’ Trailers are specialized wheeled platforms and trailers used to transfer cargo efficiently between the port and the ship. These units are not designed for use on public highways. They range from designs similar to road trailers to low-slung flats on small wheels, the latter designed to maximize the use of height within the ship.

- Common Ro-Ro Cargo Types handled on these specialized trailers include dense and heavy items such as steel coils, other steel pieces, sawn timber, paper rolls, newsprint rolls, and paper pulp. Containers themselves are also frequently carried on Ro-Ro vessels alongside other wheeled freight. This system ensures efficient loading and unloading, particularly for non-standardized or heavy wheeled items that cannot be easily lifted by traditional cranes.

Merchant Ship Categories: A Breakdown of the Global Fleet

The global merchant fleet is classified into specialized categories based on the cargo they are designed to carry, a system harmonized by international bodies like UNCTAD and Eurostat (ICST-COM). Barges are treated separately and are not included in the definition of a Merchant Ship.

Ship Classification and Key Features

Here are the main categories of merchant ships used in international maritime transport:

- 1. Liquid Bulk Carrier

- Description and Examples: Ships that carry bulk liquids, such as oil tankers, chemical tankers, and LNG (Liquefied Natural Gas) tankers.

- Key Features: Subdivided into single-hulled and double-hulled carriers for enhanced safety and environmental protection.

- 2. Dry Bulk Carrier

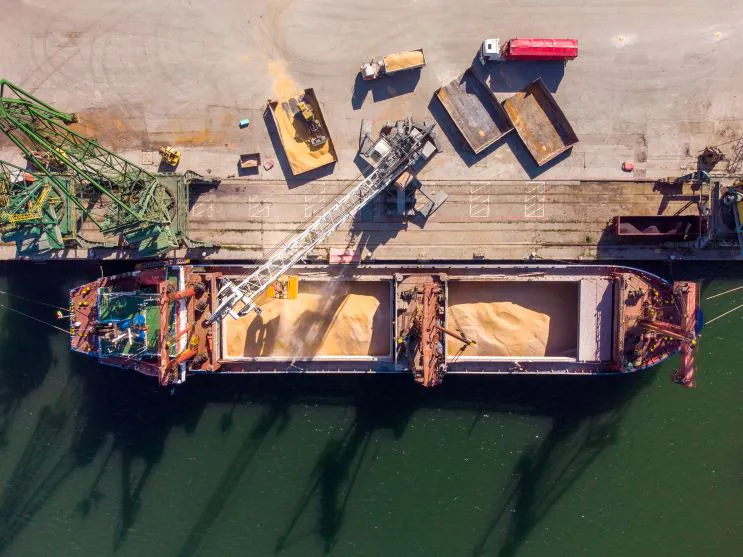

- Description and Examples: Ships designed to carry unpackaged dry cargo, including bulk/oil carriers and standard bulk carriers.

- Key Features: Optimized for carrying large volumes of commodities like grain, iron ore, coal, and cement.

- 3. Container Ship

- Description and Examples: Ships fitted throughout with fixed or portable cell guides for the exclusive carriage of intermodal containers.

- Key Features: The primary vehicle for international containerization, designed precisely around the standardized ISO container dimensions.

- 4. Specialized Carrier

- Description and Examples: Ships custom-designed for the carriage of specific, particular cargo.

- Key Features: Includes highly specific vessels such as vehicle carriers (car carriers), livestock carriers, irradiated fuel carriers, and barge carriers.

- 5. General Cargo Non-Specialized

- Description and Examples: Ships designed to carry a wide range of goods.

- Key Features: This category includes specialized types like reefer ships (refrigerated), Ro-Ro (Roll-on/Roll-off) vessels for passengers, containers, general cargo, and various combination carriers.

- 6. Dry Cargo Barge

- Description and Examples: Non-self-propelled vessels used for carrying dry cargo.

- Key Features: Includes common forms like deck barges, hopper barges, and lash-seabee barges.

- 7. Passenger Ship

- Description and Examples: Ships designed specifically to carry more than 12 fare-paying passengers (whether berthed or unberthed).

- Key Features: Subdivided based on speed into high-speed passenger ships and other conventional types.

Summary: Containerization and Moderate Maritime Trade Growth

The global maritime trade sector is a vital indicator of the world economy, exhibiting moderate growth and resilience since 2023. Despite a 2022 contraction, total volumes rebounded by 2.4% to 12.292 million tons, driven by a better-than-anticipated global economic performance (2.7% growth) and the strength of key economies like the US and China.

However, this expansion is tempered by persistent challenges, including:

- Supply chain disruptions,

- Market volatility from geopolitical tensions,

- Severe and extreme weather events,

- Increased costs, with certain groups (DCs) experiencing 30–70% higher transport costs for imported goods.

A crucial trend is the shift to longer shipping routes, evidenced by seaborne trade growth in ton-miles (distance) outpacing growth in tons (volume), impacting logistical efficiency and costs.

As global trade complexity and cost pressures rise, optimizing cargo space is critical. EasyCargo container and truck loading software is designed to address this challenge:

- Easy to Use: Web-browser-based (no installation hassle) with a modern design and fast customer support.

- Saves Space and Time: Precise item placement effectively utilizes cargo space, which reduces transportation expenses and planning time (some users report time savings of 80%).

- Best Visualization: With advanced features, it provides an interactive 3D visualization of the load plan, a manual editor with its enhanced controls to easily move placed items, and it has the ability to generate print reports from any viewpoint.

EasyCargo helps you plan your shipment using the most efficient distribution of cargo items in the given cargo space, ensuring cost-effectiveness and operational clarity. Calculate your potential savings today!

If you have containers or trucks to load, try out EasyCargo for free.